jacksonville fl county sales tax

Certain Tax Records are considered public record which means they are available to the. Tax Records include property tax assessments property appraisals and income tax records.

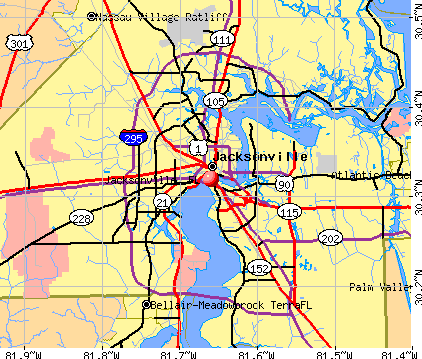

Jacksonville Florida Fl Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

2022 Florida Sales Tax By County Florida has 993 cities counties.

. In addition to the state sales and use tax rate individual Florida counties may impose a sales surtax called discretionary sales surtax or local option county sales tax. Capped at 10 increase annually. These types of assessments include garbage tax and solid waste garbage tax.

The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and 15 Duval County sales tax. Retailers are liable to the Department of Revenue for under collecting tax and retailers can be sued by their customers for over collecting tax class action tax law suits are become more common. Every 2018 combined rates mentioned above are the results of Florida state rate 6 the county rate 05 to 1.

The Jackson County sales tax rate is. The December 2020 total local sales tax rate was also 7500. 734 rows Combined with the state sales tax the highest sales tax rate in Florida is 75 in the cities of Jacksonville Tampa Tallahassee Tampa and Kissimmee and 94 other cities.

The Florida sales tax rate is currently. The 2018 United States Supreme Court decision in South Dakota v. The sales tax rate does not vary based on zip code.

Floridas general state sales tax rate is 6 with the following exceptions. The states average amount of real estate taxes was 1736 per property in 2010 which is a fairly low average. The minimum combined 2022 sales tax rate for Jackson County Florida is.

You must apply for new Local Business Tax Receipts in person at our downtown office 231 E Forsyth St. A state tax rate of 6 applies to all car sales in Florida but your total tax rate will vary based on county and local taxes which can be anywhere from 0 to 15. The current total local sales tax rate in Jacksonville FL is 7500.

Sales is under. This is the total of state county and city sales tax rates. There is no applicable city tax or special tax.

Jacksonville collects the maximum legal local sales tax. For more information regarding the tax sale process tax certificates or tax deeds please contact the Tax Department at 904 255-5700 option 4 or correspondence may be mailed to. Tax Department 231 E Forsyth St Room 130 Jacksonville FL 32202.

The Jackson County Florida sales tax is 750 consisting of 600 Florida state sales tax and 150 Jackson County local sales taxesThe local sales tax consists of a 150 county sales tax. Retail sales of new mobile homes - 3. Bay County Tourism Dev.

Depending on the zipcode the sales tax rate of Jacksonville may vary from 6 to 7. This is the total of state and county sales tax rates. To the current rate of 5 effective July 1 2018 under nassau county ordinance 2018 16.

Jacksonville Beach FL tax liens available in FL. Sales Tax and Use Tax Rate of Zip Code 32099 is located in Jacksonville City Duval County Florida State. Find the best deals on the market in Jacksonville Fl 32202 and buy a property up to 50 percent below market value.

Sales and Use Tax on Production Machinery Equipment Raw Materials Building Materials Used in Commercial Construction or Professional Services. The County sales tax rate is. For retailers in Florida keeping up with sales tax laws and exemptions can be a daunting task.

Estimated Combined Tax Rate 700 Estimated County Tax Rate 100 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount 0025. The average cumulative sales tax rate in Jacksonville Florida is 75. The average total car sales tax in Florida is 7037.

Amusement machine receipts - 4. The minimum combined 2022 sales tax rate for Jacksonville Florida is. The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and 15 Duval County sales tax.

The current total local sales tax rate in Jackson County FL is 7500. This includes the rates on the state county city and special levels. You can print a 75 sales tax table here.

The Jacksonville sales tax rate is. FL Sales Tax Rate. You may submit the manual application with other required documentation to the Customer ServiceExemptions Division at 231 E.

The latest sales tax rates for cities in Florida FL state. The fee to transfer a receipt is 600. If you need access to a database of all Florida local sales tax rates visit the sales tax data page.

Rates include state county and city taxes. None on stock or other equity Corporate Income Tax Type C. Fast Easy Tax Solutions.

Before we issue a Local Business Tax Receipt a business must meet all required conditions. The Jacksonville Florida general sales tax rate is 6. The Jackson County Sales Tax is collected by the merchant on all qualifying sales made within Jackson County.

There is no applicable city tax or special tax. Jacksonville has parts of it located within Duval County and Saint Johns County. What is the sales tax rate in Jackson County.

These types of assessments are based on the use of a property. Ad Find Out Sales Tax Rates For Free. Suite 130 Jacksonville FL 32202.

Duval County Tax Collector Attn. You can print a 75 sales tax table here. Jacksonville Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Jacksonville Florida.

Nassau county florida tax Collector office tourist development tax. Sales tax dealers must collect both discretionary sales surtax and the state sales tax from the purchaser at the time of sale and remit the taxes. One such complication that seems to cause a lot of.

They are calculated on an annual basis and can be quite high. Last updated June 2022 View County Sales Tax Rates. Exempt up to 25000.

The Florida state sales tax rate is currently. When youre shopping for cars chances are good that the number youre paying attention to is the big one on the sticker. The deadline to file timely for the 2022 Tax Roll was March 1 2022.

Tangible Personal Property Tax. 2 State Sales tax is 600. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale.

Within Jacksonville there are around 44 zip codes with the most populous zip code being 32218. 2018 rates included for use while preparing your income tax deduction.

12474 Dunraven Trl Jacksonville Fl 32223 Realtor Com

Jacksonville Fl Commercial Real Estate For Sale Crexi Com

Jacksonville Florida Facts For Kids

Duval Property Tax Deadline Extended Two Weeks Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Five Issues They Will Shape Northeast Florida In The Coming Decade Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Council Votes 12 4 To Keep Duval County Property Tax Millage Rate Unchanged Jax Daily Record Jacksonville Daily Record Jacksonville Florida

Why Jacksonville Fl Is The Next Best Real Estate Investment

5509 Weller Ave Jacksonville Fl 32211 Realtor Com

Thinking Of Moving To Jacksonville Fl

6377 Rolling Tree St Jacksonville Fl 32222 Realtor Com

Duval County Courthouse Closed To The General Public Jax Daily Record Jacksonville Daily Record Jacksonville Florida Duval County Courthouse County

2914 Leonid Rd Jacksonville Fl 32218 Realtor Com

2619 Ignition Dr Jacksonville Fl 32218 Park 295 Industrial Park Loopnet

2801 Forest Blvd Jacksonville Fl 32246 Realtor Com

814 Granada Blvd S Jacksonville Fl 32207 Realtor Com

16176 Hargett Rd Jacksonville Fl 32218 Mls 1028576 Zillow House Styles Zillow Entrance Foyer

Jacksonville Florida Community Wealth Org

Jacksonville Florida Fl Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders